Best SME Loans in Malaysia 2022

SME or also known as Small and Medium-sized Enterprises are businesses that maintain revenues, assets, or a number of employees below a certain threshold. These business entities are often regarded as the heartbeat of Malaysia’s emerging and developing economies. Apart from providing vast numbers of employment opportunities, SME businesses are generally entrepreneurial in nature, helping to shape innovation.

Generally, there are two criteria to be met in order for your business to qualify as an SME -- your annual sales turnover and the number of full time employees in your company. This also implies differently for each economy sector:

Manufacturing (Small SMEs)

- Sales turnover RM300,000 to < RM15 million

- Full time employees 5 to < 75 people

- Sales turnover RM15 million to < RM50 million

- Full time employees 75 to < 200 people

Services & Others (Small SMEs)

- Sales turnover RM300,000 to < RM3 million

- Full time employees 5 to < 30 people

- Sales turnover RM3 million to < RM20 million

- Full time employees 30 to < 75 people

Under the definition, all SMEs in Malaysia are registered with SSM or other equivalent bodies which include respective authorities/district offices in Sabah or Sarawak, or respective statutory bodies for professional service providers. However, the meaning of SME excludes business entities that are public-listed on the main board and subsidiaries of:

- Public-listed companies on the main board

- Multinational corporations (MNCs)

- Government-linked companies (GLCs)

- Syarikat Menteri Kewangan Diperbadankan (MKDs)

- State-owned enterprises

Best SME loan in Malaysia 2022

There is no one size fits all solution. Depending on your unique needs, you may consider some of the popular SME loans in Malaysia below.

1. Term LoanA term loan is probably the most common form of business loan, so it’s pretty easy to understand.

You borrow a fixed amount of money – often for a specific purchase you’re making for your business – and pay the loan back over a fixed term, most often at a fixed interest rate.

Maximum Loan Amount: RM50,000 to RM2,000,000

Loan Term: 1-5 years

Interest Rates: 4%-10%

Speed: 2- 3 Weeks

2. CGC Loan scheme

The Credit Guarantee Corporation (CGC) is a key institutional arrangement in facilitating greater access to financing by the SMEs. By providing guarantee to loans obtained by SMEs, CGC addresses one of the main constraints of SMEs that is, the lack of collateral.

Maximum Loan Amount: RM50,0000 - RM5,000,0000

Loan Term: 3-10 Years

Interest Rate: 6% - 14% p/a

Speed: 1-3 Months

3. Microfinance / Microcredit

Microcredit is the extension of very small loans (micro loans) to impoverished borrowers who typically lack collateral, steady employment and a verifiable credit history. It is designed to enable them to start a small business (micro enterprise).

Maximum Loan Amount: RM5,000 - RM50,000

Repayments: 6 months to 5 years.

Interest Rate: 6.38%-11.26% p/a

Speed: 1 Week

4. Business Trade Line

Another option to provide short term financing is trade financing. Some of the common trade financing facilities provided include:

- Letter of Credit (LC)

- Bills of Exchange Purchased (BEP)

- Trust Receipts

- Foreign Exchange Contracts

- Bankers Acceptance

- Export Credit Financing

Repayments: Flexibility to settle early, partly or fully

Interest Rate: 2% - 8% p/a

Speed: 2-3 Weeks

5. Startup Loan for business

The CGC, investors and “family and friends” are all options for your startup business to find working capital. On the Fundera Marketplace, there are two small business startup loan products that can help you get the capital you need to grow. These two products (Start-Up Loan and Personal Loan) are a more traditional form of capital and a great option if you have a strong personal credit report, and are looking to start building on your business credit, too!

Maximum Loan Amount: RM50,0000 - RM5,000,0000

Loan Term: 3-10 Years

Interest Rate: 6% - 14% p/a

Speed: 1-3 Months

6. FACTORING

Facing a problem because your clients pay in 30 to 120 days? Need to get paid sooner? Most new and growing businesses can’t afford to wait up 60 or 90 days to get paid. There are supplier and payroll commitments that must be met. But often, securing the funds to meet these obligations is difficult.

If your company or the directors is blacklisted by CTOS and CCRIS, they might still qualify to apply factoring.

- Maximum Advance: 50% to 90% of the total invoice amount.

- Repayments: When customer pays the invoice, you receive the remaining 10-50% reserve amount Minus the fees.

- Factor Fee: 3% - 6% p/a from outstanding

- Speed: 1-3 Days

The Targeted Relief and Recovery Facility (TRRF) is an allocation of RM6 billion by Bank Negara Malaysia that aims to provide relief and support recovery for eligible SMEs in the services sector.

The facility is for eligible SMEs whose revenues have been affected by the recent enhanced and conditional movement control orders, the central bank said in a statement.

Maximum Loan Amount: RM500,000

Loan Term: 1 Year - 7 Years (6 mths moratorium)

Interest Rate: 3.5% p/a

Speed: 3-4 Weeks

8. Contract Financing

Contract Financing which is specifically tailored for a specific project or contract..Financing which is specifically tailored for a specific project or contract. The financing package varies in accordance to the type of contracts i.e. construction (civil, infrastructure), supply, services etc.

The financing package provides financial support through every stage of the project.

Maximum Contract Amount: No minimum or maximum amount of financing

Repayments: Can be OD, Trade Facilities or Bank Guarantees

Interest Rate: Based on facilities

Speed: 1-3 Months

9. Short Term Loan

A short-term loan is a smaller sum of money you pay back, plus interest, with daily payments over 3 to 18 months.

Short-term loans are designed to meet short-term financing needs. They can be a flexible financial tool to better manage cash flow, deal with unexpected needs for extra cash, or take advantage of an unforeseen business opportunity.

Maximum Loan Amount: RM5,000 - RM300,000

Repayments: 3 Months - 18 Months

Interest Rate: 10% - 18%

Speed: 3 -5 Days

10. Personal Loan

A lot of people don’t know that you can actually use a personal loan for business purposes. Personal loans are especially helpful for new businesses that don’t have a long financial history to show lenders.

Personal loans can often have lower interest rates than some business loans, making it a great option for young companies looking for financing to grow their business.

Maximum Loan Amount: RM5,000 - RM250,000

Repayments: 1 - 7 Years

Interest Rate: Starting from 6% p/a

Speed: As little as 3 days

11. OVERDRAFT

Allows you to draw additional funds quickly and conveniently from your current account when you require it. Raising additional Capital for running a business or making investments is now fast, simple and convenient.

Here's what Overdraft offers you:

- No fixed repayment schedule.

- Interest charged only when funds are used.(However, will charge you 1% p.a. commitment fees on the unused amount)

- Easy to use

Repayments: No fixed repayment schedule, normally is yearly review.

Interest Rate: BLR+ (7% - 10% p/a)

Speed: 3-4 Weeks

12. GRANTS

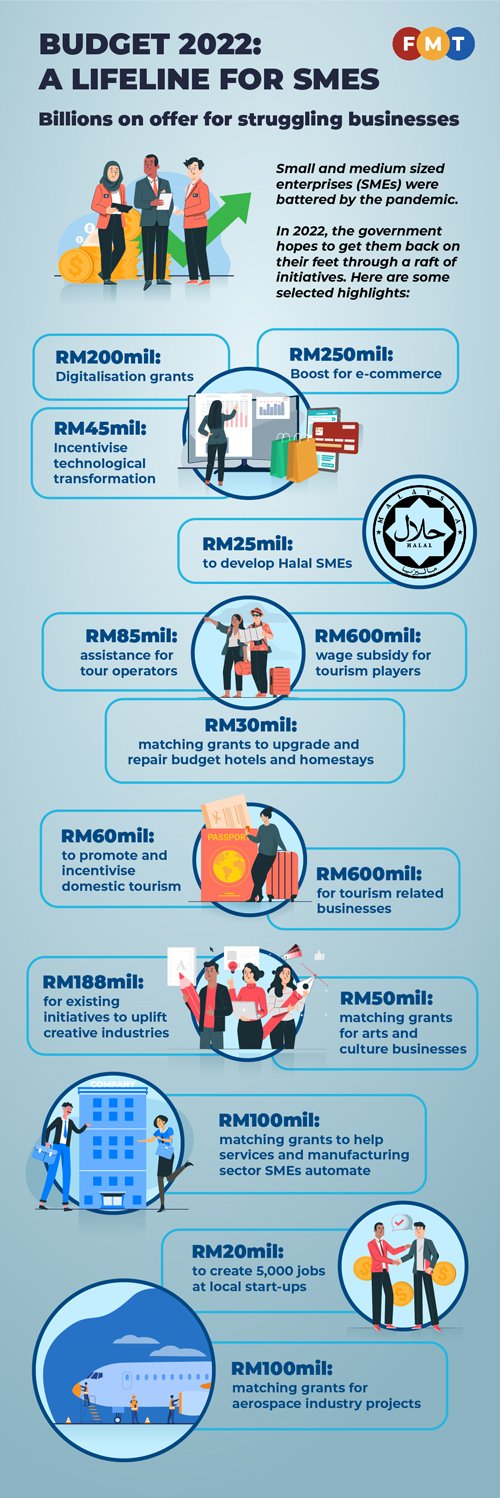

The government of Malaysia offers grants to citizens for purposes of establishing and running their small businesses. However, not everyone out there is eligible to qualify for these grants. A government grant has certain pre-qualifications attached to it just like the case is for a bank loan. The good thing about grants is that there are either low or no interest tags attached to them.

There are many types of government grants offered by various government agencies open for application.

- MSC (Multimedia Development Corporation)

- MATRADE (Malaysia External Trade Development Corporation)

- MBC (Malaysian Biotechnology Corporation)

- Ministry of Tourism Malaysia

- Shell Malaysia Sustainable Development (SD) Grants scheme

- CIP (Cradle Investment Program)

- MTDC (Malaysian Technology Development Corporation)

- MOSTI (Ministry of Science, Technology and Innovation)

- MDEC (Multimedia Development Corporation)

- NEF (New Entrepreneur Foundation)

- SME Corporation

- MPC (Malaysia production Coorporation

- Pitcom Venture

Repayments: Non

Interest Rate: Non

Speed: 4-5 Months

Comments

Post a Comment